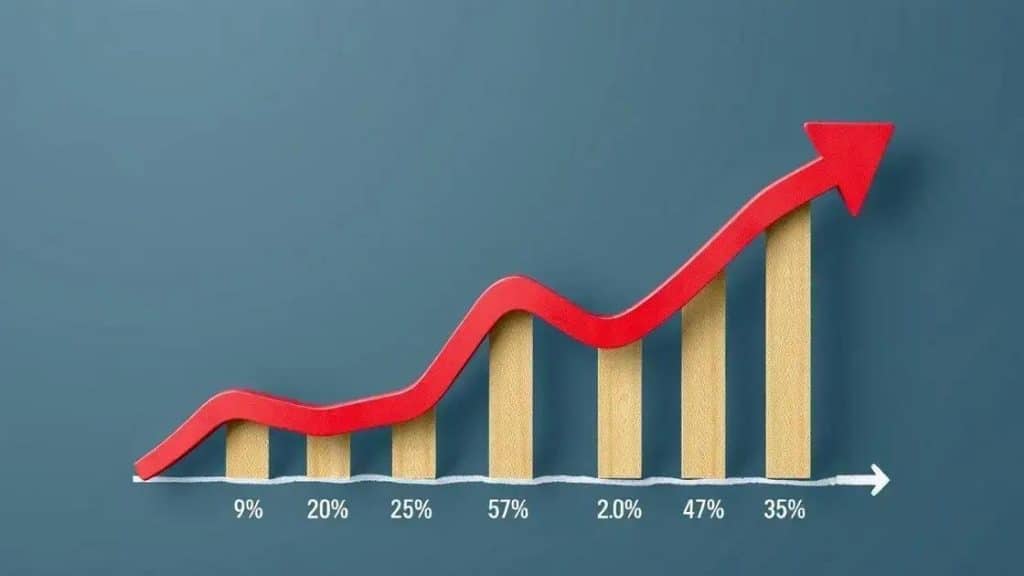

Inflation data analysis April 2025 reveals surprising trends

Anúncios

Managing inflation impacts involves budgeting wisely, making informed investments in inflation-resistant assets, and shopping smart by seeking discounts and comparing prices to maintain financial stability.

Inflation data analysis April 2025 offers a deeper look at the recent economic shifts that might surprise you. Have you noticed a change in prices at your local store? Understanding these trends can help you navigate your finances better.

Anúncios

Current inflation trends and their implications

Understanding the current inflation trends is essential for anyone looking to make informed financial decisions. Many factors contribute to inflation, including supply chain disruptions, changes in consumer demand, and government policies. These trends can significantly impact your purchasing power and overall economic health.

Key Factors Driving Current Inflation

Several factors are currently influencing inflation. These include:

Anúncios

- The ongoing effects of the pandemic on supply chains.

- Shifts in consumer behavior as people return to normal life.

- Changes in government policies, such as stimulus packages.

- Global events that impact energy and food prices.

Each of these elements plays a role in shaping the inflation landscape we see today. For instance, when consumer demand increases, prices often rise if supply cannot keep up. This dynamic is crucial to understand as it directly impacts your daily expenses.

Implications for Consumers

The implications of these inflation trends can be profound. As inflation rises, you may notice that everyday items cost more, from groceries to gas. This can lead to tighter budgets and a shift in spending habits. It’s important to adjust your financial strategies accordingly to mitigate the impact of rising prices.

For example, consumers might prioritize essential purchases over luxury items during high inflation periods. Understanding these behaviors allows you to make smarter financial choices and plan ahead. Building an emergency fund and considering investments that traditionally perform well during inflation could also be wise strategies.

In summary, recognizing the current inflation trends and their implications helps you stay ahead in your financial planning. By being informed, you can adapt to changes and make better financial decisions.

Factors influencing inflation in April 2025

Several key factors influencing inflation in April 2025 are shaping the economic landscape. Understanding these elements can help you grasp why prices are changing and how they might affect your budget.

Economic Recovery Post-Pandemic

One significant factor is the economic recovery following the pandemic. As businesses reopen and consumers spend more, demand is increasing. This heightened demand can lead to higher prices if supply does not keep pace. Keeping an eye on this balance is crucial for predicting future inflation trends.

Moreover, government stimulus packages are also contributing to inflation by injecting more money into the economy. This financial boost allows consumers to spend more, which can drive prices up further.

Supply Chain Challenges

Another major influence is the ongoing supply chain challenges. Disruptions caused by labor shortages, shipping delays, and geopolitical tensions have made it hard for companies to maintain normal production levels. As a result, limited availability of goods can push prices higher.

- Increased shipping costs due to global constraints.

- Raw material shortages affecting production timelines.

- Labor shortages leading to reduced operational capacity.

These supply side factors are critical in understanding how inflation is being driven in the market. When there are fewer products available, prices tend to rise, creating a ripple effect across various sectors.

Energy Prices and Global Events

Energy prices are another important contributor to inflation. Fluctuations in oil and gas prices can increase transportation and manufacturing costs. These increases often pass down to consumers as higher prices for goods and services.

Global events, such as conflicts or natural disasters, can also impact supply chains and energy costs. These unpredictable factors make it even more challenging to forecast inflation accurately.

Ultimately, recognizing these factors influencing inflation will help you navigate the economy more effectively. By understanding the reasons behind price changes, you can make more informed financial decisions.

How inflation affects consumer behavior

Inflation significantly impacts consumer behavior, influencing how people spend their money. As prices rise, consumers often adjust their purchasing habits to maintain their budgets. Understanding these changes can help businesses respond to consumer needs more effectively.

Shifts in Spending Preferences

When inflation is high, consumers tend to prioritize essential items over luxury goods. This can lead to a decrease in sales for non-essential products. Companies may need to adapt their marketing strategies to meet this changing demand.

- Increased focus on value: Consumers look for the best deals.

- Heightened interest in discounts and sales.

- More cautious spending on non-essentials.

As prices rise, many shoppers start to compare prices more rigorously. They may switch to generic brands or look for specials more frequently. This shift can create opportunities for businesses that offer competitive pricing.

Impact on Savings and Investing

Inflation also affects how consumers approach saving and investing. With rising prices, people may feel less inclined to save money since their purchasing power decreases over time. This can lead to a preference for investing in assets that typically hold their value during inflationary periods.

For instance, consumers might invest in real estate, commodities, or inflation-protected securities. Understanding these trends helps financial advisors provide better guidance during times of economic uncertainty.

Moreover, consumers may choose to hold on to physical cash less often. When inflation is anticipated, they might prefer to invest immediately rather than let their money lose value.

By recognizing how inflation affects consumer behavior, businesses and individuals can navigate economic challenges more effectively. Being aware of these shifts allows consumers to make smarter financial decisions, while companies can better align their strategies with market demands.

Practical tips for managing inflation impacts

Managing the impacts of inflation can be challenging, but with the right strategies, you can protect your finances. Implementing practical tips can help you navigate rising prices and maintain your purchasing power.

Budgeting Wisely

Creating a detailed budget is one of the best ways to manage your finances during inflation. Monitor your income and expenses closely to identify areas where you can cut back. This can help you allocate funds for essential purchases while reducing unnecessary spending.

- Track your spending using a budgeting app.

- Identify non-essential expenses to reduce.

- Set realistic savings goals to navigate tougher times.

Regularly revising your budget allows you to adapt to changing prices and prioritize your spending.

Consider Long-Term Investments

Investing in assets that tend to retain value during inflation can be a smart move. Stocks, real estate, and commodities often provide a hedge against rising prices. Consider diversifying your investment portfolio to include these types of assets.

Moreover, look for investment options that offer returns that outpace inflation. Staying informed about market trends can guide you in making effective investment choices.

Shopping Smart

When inflation rises, shopping smart becomes essential. Look for discounts, use coupons, and compare prices before making a purchase. It can also be beneficial to buy in bulk for items you frequently use, as this may save you money over time.

Consider shopping at stores with a reputation for competitive pricing or buying generic brands to save more on everyday items. Every dollar saved contributes to maintaining your overall budget.

Understanding how to manage the impacts of inflation helps you remain financially stable even in uncertain times. By adopting thoughtful strategies, you can navigate challenges more effectively and continue to meet your financial goals.

FAQ – Practical tips for managing inflation impacts

What is the best way to adjust my budget during inflation?

The best way to adjust your budget is to track your expenses closely and identify non-essential items to cut back on.

How can I protect my investments from inflation?

You can protect your investments by diversifying into assets like stocks, real estate, and commodities that typically retain value during inflation.

What should I look for when shopping to save money during inflation?

When shopping, look for discounts, utilize coupons, and compare prices across different stores before making a purchase.

Is it wise to buy in bulk during inflation?

Yes, buying in bulk for frequently used items can save money in the long run, especially during inflation.